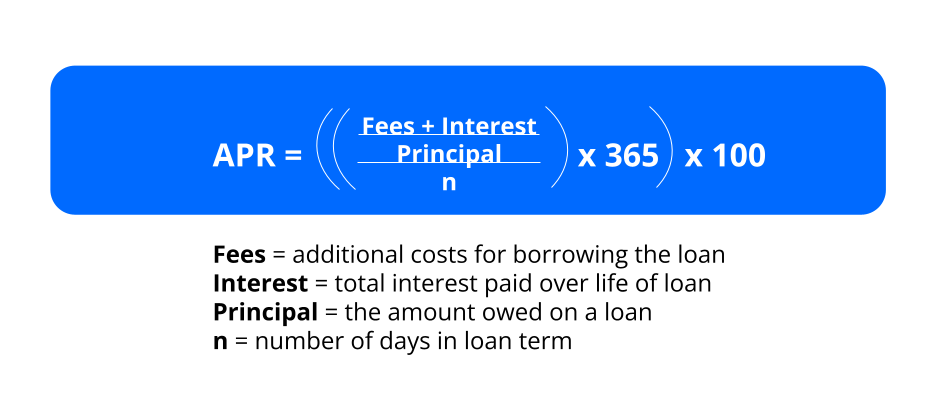

Loan interest is usually expressed in APR or annual. Interest Principal x Rate x Number of Periods.

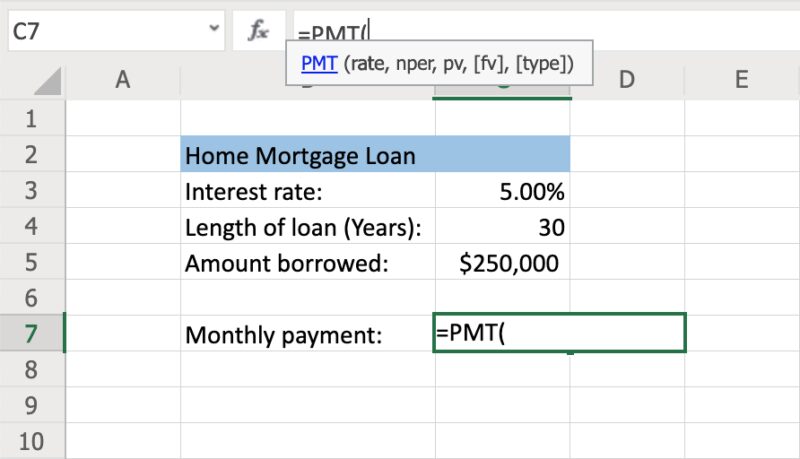

Use Excel To Find The Payment And Total Interest On A Loan

Daily simple interest formula calculation Opening balance x interest rate 365 x number of days between payments interest due for the month Example 2 200000 x 04 365 x 30 219.

. To use this formula make sure. There is a single formula that assists you in determining the interest rate and total amount repayable in EMIs. This does not include any down.

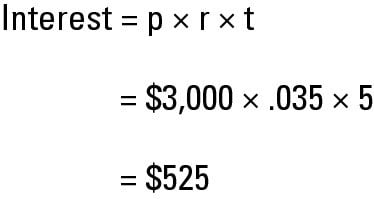

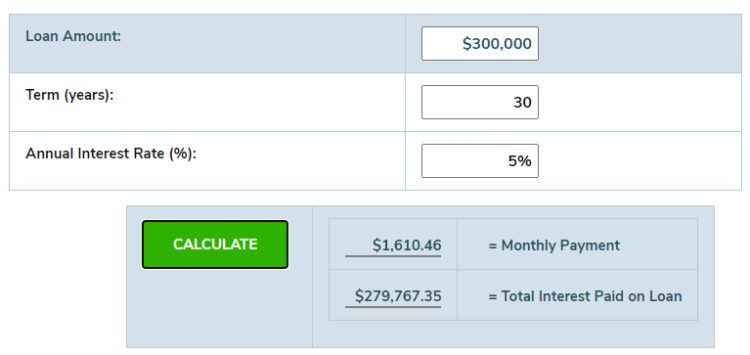

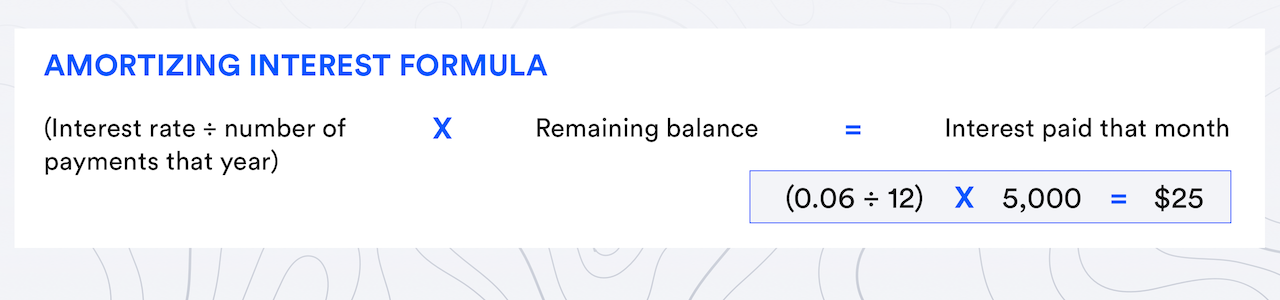

Interest rate is the percentage of a loan paid by borrowers to lenders. Now that you have the monthly payment you can determine how much interest you will pay over the life of the loan. To calculate simple interest on a loan take the principal P times the interest rate R times the loan term in years T then divide the total by 100.

Convert the monthly rate in decimal format back. To calculate the monthly interest on 2000 multiply that number by the total amount. About Loan Repayment Calculator.

5 years have a total of 5X12 60 months C8 Pv Third Argument Total loan amount or Principal 5000 Step 2. Multiply the number of payments over the life of the loan by. To get the monthly payment amount for a loan with four percent interest 48 payments and an amount of 20000 you would use this formula.

How Is My Interest Payment Calculated. There are three main components when determining your total loan interest. A simple interest calculator helps you calculate the interest taken on loans that is to be paid without compounding it.

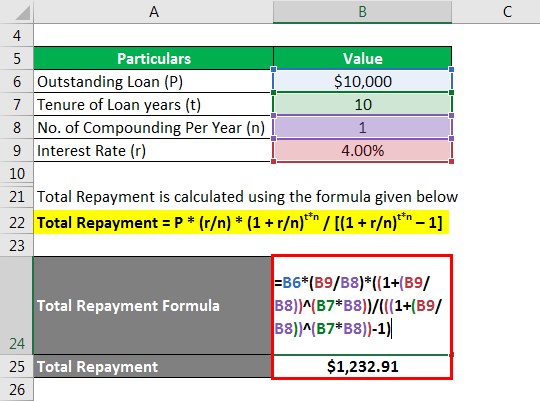

The formula for calculating Mortgage as per below. Loan interest calculation and determining EMIs relies on a specific formula. We have 5 years to pay back the loan.

The principal is the beginning balance the interest rate is the given rate expressed. It is E P r 1rn 1rn-1 In the equation the following are. Using the simple interest calculator you can find simple.

00083 x 2000 1660 per month. Methodology for Interest-Only Loan Payments. Heres the equation to calculate simple interest.

There are two methods for calculating interest. Its simpler to calculate repayments for an interest-only loan. For most loans interest is paid in addition to principal repayment.

Interest P x R x T Where. Lenders multiply your outstanding balance by your annual interest rate but divide by 12 because youre making monthly payments. P R 1RN 1RN-1 Wherein P is the loan amount.

This is the total amount you are borrowing. To begin multiply the yearly interest rate r by the amount of expenditure made. PMT B212B3B4 As you.

Principal Loan Amount x Interest Rate x Repayment Tenure Interest So if your principal loan amount is INR 20000 Interest Rate is 5 percent and the repayment tenure is 3 years then you. P Principal the amount of money you borrow R Annual Interest Rate the percentage of interest that accrues each year T Term the length of. Every interest calculator in India utilises the formula below - EMI P x r x 1r n 1r n-1 In this.

R is the rate of interest per annum. Simple interest is calculated as a percentage of principal only while compound interest is calculated as a percentage of the principal along.

How To Calculate Interest Rate On A Car Loan Weir Canyon Acura

How To Calculate Simple And Compound Interest Dummies

How To Calculate Monthly Loan Payments In Excel Investinganswers

How To Find Interest Principal Payments On A Loan In Excel Youtube

Amortized Loan Formula Calculator Example With Excel Template

Excel Formula Calculate Interest Rate For Loan Exceljet

Loan Interest Calculator How Much Will I Pay In Interest

Ultimate Construction Loan Calculator Irregular Borrows

How To Calculate A Loan Payment Interest Or Term In Excel

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

:max_bytes(150000):strip_icc()/loan-payment-calculations-315564-70a2f63dbd624881b63ec5392209c9a6.gif)

What Is The Formula For A Monthly Loan Payment

How To Calculate Interest Rates On Bank Loans

Use Excel To Find The Payment And Total Interest On A Loan

How To Calculate Interest Rate On A Car Loan Metro Honda

Monthly Payment Formula How To Calculate Loan Payments Video Lesson Transcript Study Com

How To Calculate Loan Interest Bankrate